take home pay calculator madison wi

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. Bonuses are considered supplemental wages and as such are subject to a different method of taxation.

Wisconsin Paycheck Calculator Adp

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

. Supports hourly salary income and multiple pay frequencies. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Living Wage Calculation for Madison WI.

Wisconsin Mobile Home Tax. We issue a wage attachment for 25 of gross earnings per pay period. The tool provides information for individuals and households with one or two working adults and.

To use our Wisconsin Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels. Take home pay calculator madison wi.

Madisons housing expenses are 9 higher than the national average and the utility prices are 5 higher than the national average. Wisconsin Department of Revenue. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year.

View future changes in the minimum wage in your location by visiting Minimum Wage Values in. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Overview of Wisconsin Taxes.

If youre eligible for a 10000 bonus you might only come away with just over 6000 of it once taxes are applied. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and.

If youre eligible for a 10000 bonus you might only come away with just over 6000 of. After a few seconds you will be provided with a full breakdown of the tax you are paying. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Wisconsin State Income Tax Rates and Thresholds in 2022. The tax rates which range from 354 to 765 are dependent on income level and filing status. So if your.

Use this calculator to help determine your net take-home pay from a company bonus. Wisconsin Cigarette Tax. I your monthly interest rate.

P the principal amount. Details of the personal income tax rates used in the 2022 Wisconsin State Calculator are published below the. Transportation expenses like bus fares and gas prices are 7.

The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The tax rates which range from 354 to 765 are dependent on income level and filing status.

Wisconsin workers are subject to a progressive state income tax system with four tax brackets. The tool provides information for individuals and households with one or two working adults and. Living Wage Calculation for Wisconsin.

The assumption is the sole provider is working full-time 2080 hours per year. Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator. Calculate your take home pay from hourly wage or salary.

Switch to Wisconsin salary calculator. Most employers tax bonuses via the flat tax method where an automatic 25 tax is applied to your payment. The process is simpler than you think.

Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. This free easy to use payroll calculator will calculate your take home pay.

14000000 salary example for employee and employer paying Wisconsin State tincome taxes. Cigarettes are taxed at 252 per pack in Wisconsin. Include on the check stub or memo.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The 2022 wage base is 147000. Wisconsin Department of Revenue.

Detailed salary after tax calculation including Wisconsin State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Wisconsin state tax tables. Madison WI salaries are collected from government agencies and companies. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis. Well do the math for youall you need to do is enter the applicable information on salary federal and state. Of course the calculators dont take into account all the factors that should be considered when choosing a new mortgage they are designed just to.

More information about the calculations performed is available on the about page. Madison WI average salary is 73895 median salary is 69534 with a salary range from 25653 to 364000. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Savannah Ios 14 App Covers Ios 14 Icon Covers Etsy App Covers Iphone Minimal Iphone Design Include the employees full name and the payment key Read More Take Home Pay. Sample Car Loan Amortization Schedule Template Car loan. Make your check payable to.

Wisconsin Salary Paycheck Calculator. Process and Data Services. This is the 19th-highest cigarette tax in the country.

The calculators we provide here can help you decide what type of mortgage is best for you whether you are considering purchasing a new home or deciding if it is the right time to refinance. Note that bonuses that exceed 1 million are subject to an even higher rate of 396 Now 25 may not seem like all that much but if. Employers must match this tax dollar-for-dollar.

For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. Free Online Paycheck Calculator for Calculating Net Take Home Pay. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay.

After you request a waiver begin sending your payments by check immediately. Switch to Wisconsin hourly calculator. The assumption is the sole provider is working full-time 2080 hours per year.

Wisconsin Paycheck Calculator Smartasset

Wisconsin Paycheck Calculator Smartasset

The Easiest Wisconsin Child Support Calculator Instant Live

Your Offer Office Of Student Financial Aid Uw Madison

Wisconsin Dells Ducks Wisconsin Dells Vacation Wisconsin Dells Wisconsin Travel

Born And Raised In This Wonderfaul State Wisconsin Wisconsin Football Words

Mt Olympus Wisconsin Dells Yahoo Image Search Results Wisconsin Vacation Wisconsin Dells Vacation Wisconsin Dells

How To Calculate Adjusted Basis On Sale Of Rental Property Sapling Com Sapling Com Rental Property Daycare Buying Foreclosed Homes

Pin By Amani On B A D D I E S H I T I P S School Survival Kits Life Hacks For School High School Hacks

Wisconsin Income Tax Calculator Smartasset

Pin By Jill On Flooring Flooring Hardwood Floors Home

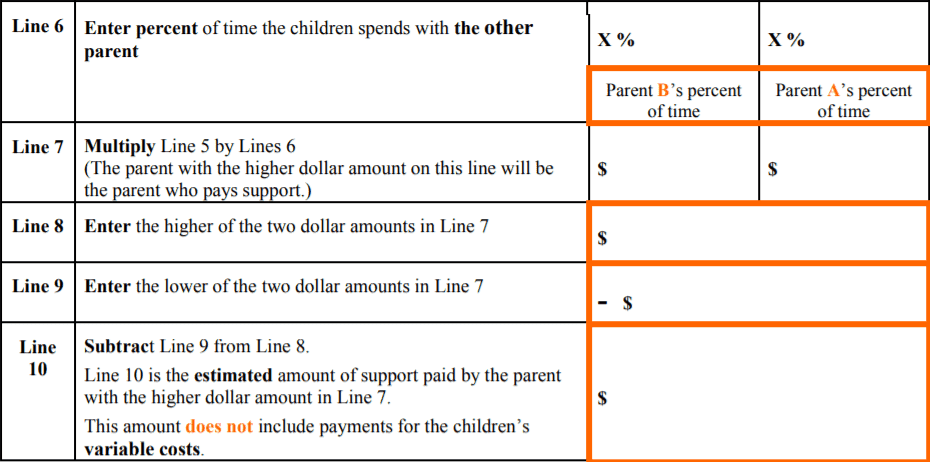

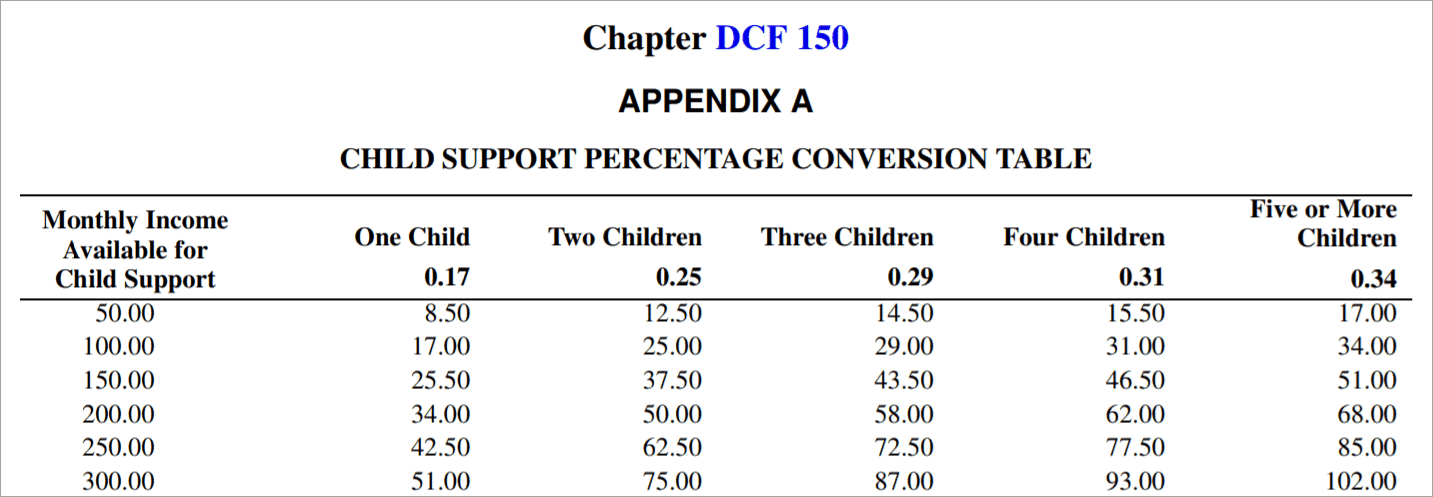

Calculating Child Support In Wisconsin

Es La Un Calculadora Me Gusta La Marca Texas Instruments With Images Calculator Mortgage Payment

Wisconsin Income Tax Calculator Smartasset

Dor Adjusting The Wisconsin Basis Of Depreciated Or Amortized Assets

Wisconsin Child Support Calculators Worksheets 2022 Sterling Law Offices S C

Wisconsin Paycheck Calculator Adp

Pin Van Michael Francis Op Diet Ideas Ketosis Diet Keto Diet Recipes Keto Supplements